Saving vs. Borrowing

Previous generations have funded higher education by taking out student loans. However, as tuition increases, student loan balances are increasing too. The amount of debt graduates accumulate can play a significant role in how soon they are able to pursue major life goals.

By saving for college early, students may be able to borrow less for their degrees. After graduation, this can help free up income for other life goals, such as buying a new home or saving for retirement.

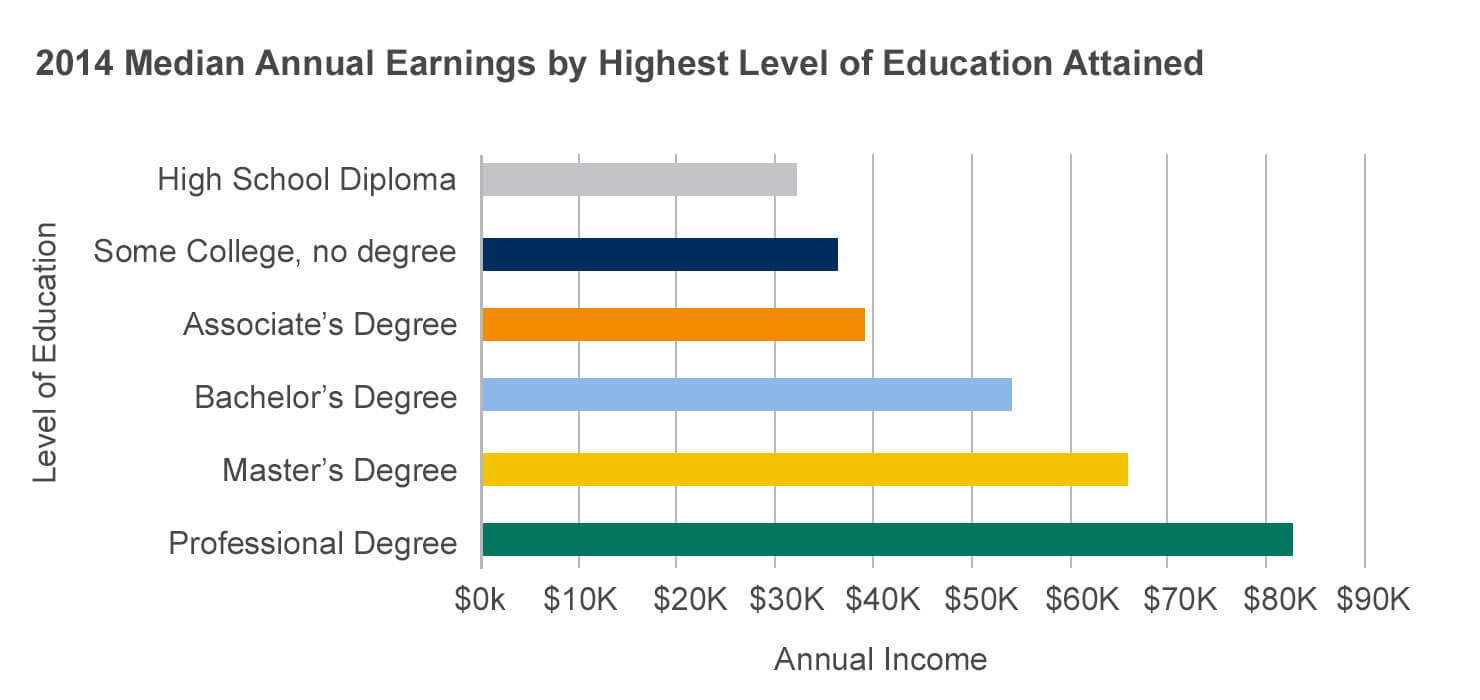

Absolutely - it's about future earnings and independence. Over a lifetime, the earnings gap between Bachelors or Associates degree-holders, and High School diploma-holders widens, and its impact can be significant.

Research shows that college degrees produce greater financial success.

Source: Chart is based on 2014 median earnings for full-time wage and salary workers who are at least 25 years old. Chart data source: Current Population Survey, U.S. Bureau of Labor and Statistics, U.S. Department of Labor, U.S. Census Bureau, 2015.

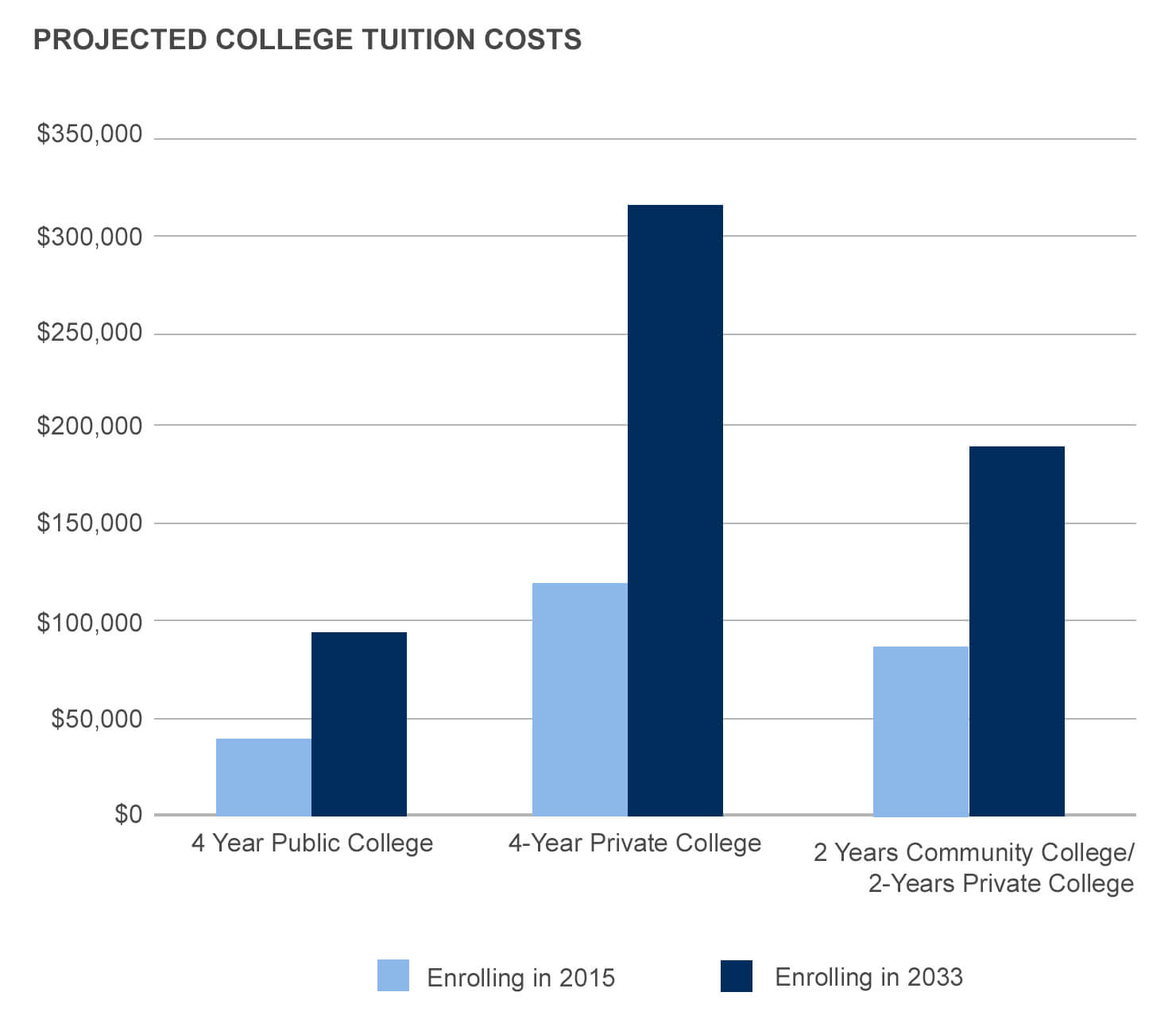

A lot. Over the past three decades, the cost of tuition has outpaced the Consumer Price Index of inflation, and while there are different ways to approach college, from starting at a 2-year community college and then transferring to a 4-year institution, it does remain expensive.

Based on average tuition and fees for 2014-15 as reported by The College Board® and assumed to increase 5% annually. (This is a hypothetical example for illustrative purposes only.) ®

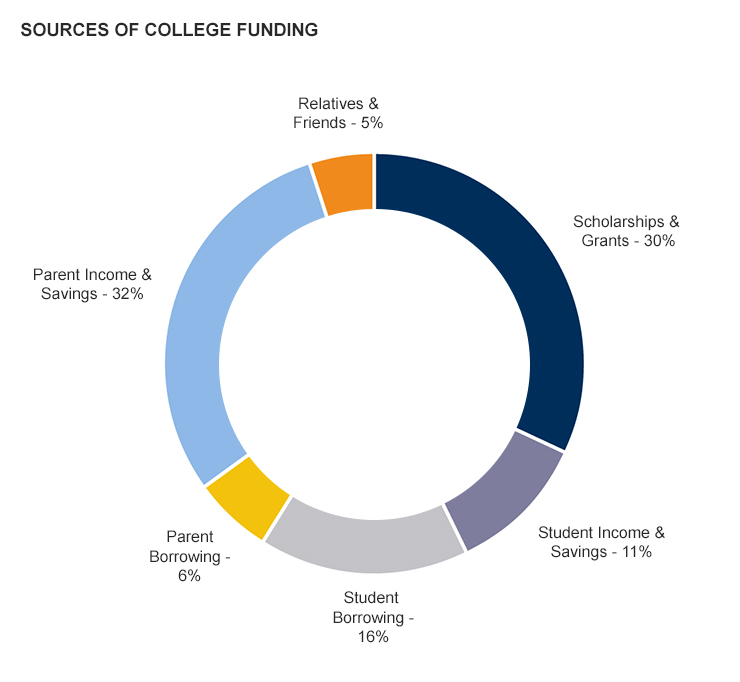

Most families use a combination of savings, scholarships/grants and loans to pay for college.

In 2015, parent income and savings became the #1 source of college funding, surpassing scholarships and grants for the first time since 2010.

Source: How America Pays for College 2015 National Study by Sallie Mae & Ipsos

At over $1.3 trillion, national student debt is at historic highs, exceeding both the nation's credit card and auto loan debt levels, with no end in sight. Student debt stays with an individual for their lifetime — and sometimes beyond — and plays a large role in how soon college graduates are able to purchase their first home, or start their own family.

Save vs. Borrow $35,000 for College

Assumes: Initial investment of $2,000 monthly investment of $250, 6% interest rate, and saving for 18 years.

The examples are for illustrative purposes only and do not represent any particular type of loan. The loan is based on an interest rate of 8.5% and assumes it is paid off in 10 years. The calculators do not include inflation or any fees associated with the loan. Your results could be different and will depend on the type of loan.

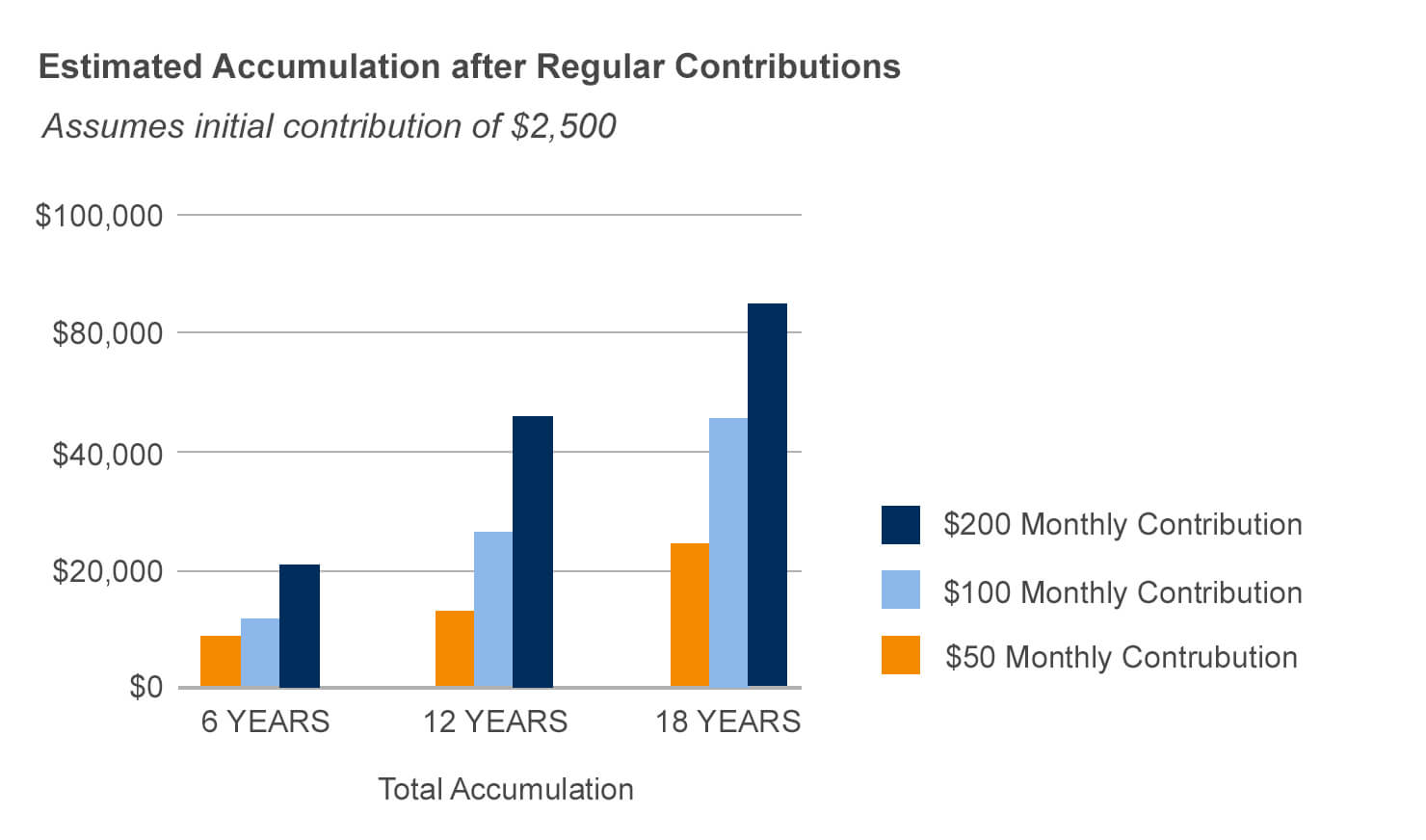

So how can a family prepare itself financially to meet these costs? Save little and save often. Put time on your side.

Saving is a critical piece in a family's overall college financing strategy. The College Savings Foundation's annual State of College Savings survey of 800 parents showed that those parents who invested in 529s and those who habitually saved with automatic savings plans — each saved more than parents without them.

Chart based on these assumptions: Monthly investment is made at the beginning of each month. Investment begins with a balance of $2,500 and earns an 6% average annual return. All projections are before taxes are paid. This information is for illustration purposes only and is not intended to represent any particular investment product.